AeroVironment, Inc. Announces Fiscal 2020 Full Year and Fourth Quarter Results

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200623005863/en/

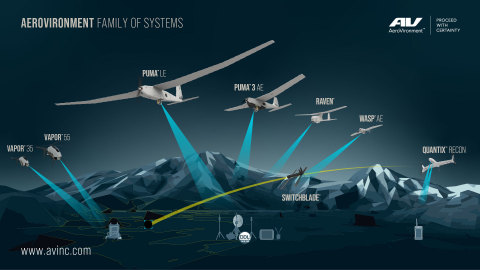

AeroVironment’s Family of Systems provide multi-mission capabilities for defense and commercial customers, and precision strike at the battlefield’s edge (Graphic: Business Wire)

-

Record fourth quarter and full year revenue of

$135.2 million and$367.3 million , an increase of 54 percent and 17 percent year-over-year, respectively -

Fourth quarter diluted earnings per share from continuing operations and non-GAAP diluted earnings per share from continuing operations of

$0.73 and$0.75 , an increase of47 cents and49 cents year-over-year, respectively -

Record funded backlog of

$208.1 million , providing strong momentum toward a fourth consecutive year of profitable growth

“Our team delivered outstanding results in our fourth quarter and full fiscal year 2020. We established new records for highest quarterly revenue, highest fiscal year revenue, and highest funded backlog for the full fiscal year 2020. With continued focus on our business strategy, coupled with excellent execution by our committed and talented team, we delivered our third consecutive year of profitable, double-digit topline growth,” said

“We achieved numerous significant milestones this fiscal year, including successfully completing initial flight tests of the HAWK30 solar-HAPS system, securing the largest

FISCAL 2020 FOURTH QUARTER RESULTS

Revenue for the fourth quarter of fiscal 2020 was

Gross margin for the fourth quarter of fiscal 2020 was

Income from continuing operations for the fourth quarter of fiscal 2020 was

Other income, net, for the fourth quarter of fiscal 2020 was

Provision for (benefit from) income taxes for the fourth quarter of fiscal 2020 was a provision of

Equity method investment loss, net of tax, for the fourth quarter of fiscal 2020 was

Net income attributable to

Earnings per diluted share from continuing operations attributable to

Non-GAAP earnings per diluted share from continuing operations was

FISCAL 2020 FULL YEAR RESULTS

Revenue for fiscal 2020 was

Gross margin for fiscal 2020 was

Income from continuing operations for fiscal 2020 was

Other income, net for fiscal 2020 was

Provision for income taxes for fiscal 2020 was

Equity method investment loss, net of tax for fiscal 2020 was

Net income attributable to

Earnings per diluted share from continuing operations attributable to

Non-GAAP earnings per diluted share from continuing operations for fiscal 2020 was

BACKLOG

As of

FISCAL 2021 — OUTLOOK FOR THE FULL YEAR

For fiscal 2021, the Company expects to generate revenue between

The foregoing estimates are forward-looking and reflect management's view of current and future market conditions, including certain assumptions with respect to our ability to obtain and retain government contracts, changes in the timing and/or amount of government spending, changes in the demand for our products and services, activities of competitors, changes in the regulatory environment, and general economic and business conditions in

UPDATED CONFERENCE CALL AND PRESENTATION

In conjunction with this release,

Investors may dial into the call by using the following updated telephone numbers, (877) 561-2749 (

Investors with Internet access may listen to the live audio webcast via the Investor Relations page of the

A supplementary investor presentation for the fourth quarter and full fiscal 2020 can be accessed at https://investor.avinc.com/events-and-presentations.

Updated Audio Replay Options

An audio replay of the event will be archived on the Investor Relations page of the company's website, at http://investor.avinc.com. The audio replay will also be available via telephone from

ABOUT

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” or words or phrases with similar meaning. Forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements.

Factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to, reliance on sales to the

NON-GAAP MEASURES

In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), this earnings release also contains a non-GAAP financial measure. See in the financial tables below the calculation of this measure, the reasons why we believe this measure provides useful information to investors, and a reconciliation of this measure to the most directly comparable GAAP.

|

Consolidated Statements of Operations (Unaudited) (In thousands except share and per share data) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

|||||||

|

|

|

(Unaudited) |

|

|

||||||||||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Product sales |

|

$ |

97,101 |

|

|

$ |

59,696 |

|

|

$ |

256,758 |

|

|

$ |

212,089 |

|

|

Contract services |

|

|

38,122 |

|

|

|

28,234 |

|

|

|

110,538 |

|

|

|

102,185 |

|

|

|

|

|

135,223 |

|

|

|

87,930 |

|

|

|

367,296 |

|

|

|

314,274 |

|

|

Cost of sales: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Product sales |

|

|

56,887 |

|

|

|

30,331 |

|

|

|

139,131 |

|

|

|

113,489 |

|

|

Contract services |

|

|

25,168 |

|

|

|

20,576 |

|

|

|

75,063 |

|

|

|

72,382 |

|

|

|

|

|

82,055 |

|

|

|

50,907 |

|

|

|

214,194 |

|

|

|

185,871 |

|

|

Gross margin: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Product sales |

|

|

40,214 |

|

|

|

29,365 |

|

|

|

117,627 |

|

|

|

98,600 |

|

|

Contract services |

|

|

12,954 |

|

|

|

7,658 |

|

|

|

35,475 |

|

|

|

29,803 |

|

|

|

|

|

53,168 |

|

|

|

37,023 |

|

|

|

153,102 |

|

|

|

128,403 |

|

|

Selling, general and administrative |

|

|

16,344 |

|

|

|

20,277 |

|

|

|

59,490 |

|

|

|

60,343 |

|

|

Research and development |

|

|

15,529 |

|

|

|

11,603 |

|

|

|

46,477 |

|

|

|

34,234 |

|

|

Income from continuing operations |

|

|

21,295 |

|

|

|

5,143 |

|

|

|

47,135 |

|

|

|

33,826 |

|

|

Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Interest income, net |

|

|

1,111 |

|

|

|

1,426 |

|

|

|

4,828 |

|

|

|

4,672 |

|

|

Other income, net |

|

|

75 |

|

|

|

1,339 |

|

|

|

707 |

|

|

|

11,980 |

|

|

Income from continuing operations before income taxes |

|

|

22,481 |

|

|

|

7,908 |

|

|

|

52,670 |

|

|

|

50,478 |

|

|

Provision for (benefit from) income taxes |

|

|

2,645 |

|

|

|

(83 |

) |

|

|

5,848 |

|

|

|

4,641 |

|

|

Equity method investment loss, net of tax |

|

|

(2,077 |

) |

|

|

(1,873 |

) |

|

|

(5,487 |

) |

|

|

(3,944 |

) |

|

Net income from continuing operations |

|

|

17,759 |

|

|

|

6,118 |

|

|

|

41,335 |

|

|

|

41,893 |

|

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(Loss) gain on sale of business, net of tax |

|

|

(265 |

) |

|

|

38 |

|

|

|

(265 |

) |

|

|

8,490 |

|

|

Loss from discontinued operations, net of tax |

|

|

— |

|

|

|

(453 |

) |

|

|

— |

|

|

|

(2,964 |

) |

|

Net (loss) income from discontinued operations |

|

|

(265 |

) |

|

|

(415 |

) |

|

|

(265 |

) |

|

|

5,526 |

|

|

Net income |

|

|

17,494 |

|

|

|

5,703 |

|

|

|

41,070 |

|

|

|

47,419 |

|

|

Net (income) loss attributable to noncontrolling interest |

|

|

(23 |

) |

|

|

(21 |

) |

|

|

4 |

|

|

|

19 |

|

|

Net income attributable to |

|

$ |

17,471 |

|

|

$ |

5,682 |

|

|

$ |

41,074 |

|

|

$ |

47,438 |

|

|

Net income (loss) per share attributable to |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Continuing operations |

|

$ |

0.74 |

|

|

$ |

0.26 |

|

|

$ |

1.74 |

|

|

$ |

1.77 |

|

|

Discontinued operations |

|

|

(0.01 |

) |

|

|

(0.02 |

) |

|

|

(0.01 |

) |

|

|

0.23 |

|

|

Net income per share attributable to |

|

$ |

0.73 |

|

|

$ |

0.24 |

|

|

$ |

1.73 |

|

|

$ |

2.00 |

|

|

Net income (loss) per share attributable to |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Continuing operations |

|

$ |

0.73 |

|

|

$ |

0.26 |

|

|

$ |

1.72 |

|

|

$ |

1.74 |

|

|

Discontinued operations |

|

|

(0.01 |

) |

|

|

(0.02 |

) |

|

|

(0.01 |

) |

|

|

0.23 |

|

|

Net income per share attributable to |

|

$ |

0.72 |

|

|

$ |

0.24 |

|

|

$ |

1.71 |

|

|

$ |

1.97 |

|

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Basic |

|

|

23,849,575 |

|

|

|

23,718,030 |

|

|

|

23,806,208 |

|

|

|

23,663,410 |

|

|

Diluted |

|

|

24,133,809 |

|

|

|

24,094,717 |

|

|

|

24,088,167 |

|

|

|

24,071,713 |

|

|

Consolidated Balance Sheets (In thousands except share data) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

2020 |

|

2019 |

||

|

Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

255,142 |

|

$ |

172,708 |

|

Held-to-maturity short-term investments |

|

|

— |

|

|

150,487 |

|

Available-for-sale short-term investments |

|

|

47,507 |

|

|

— |

|

Accounts receivable, net of allowance for doubtful accounts of |

|

|

73,660 |

|

|

31,051 |

|

Unbilled receivables and retentions |

|

|

75,837 |

|

|

53,047 |

|

Inventories |

|

|

45,535 |

|

|

54,056 |

|

Prepaid expenses and other current assets |

|

|

6,246 |

|

|

7,418 |

|

Income taxes receivable |

|

|

— |

|

|

821 |

|

Total current assets |

|

|

503,927 |

|

|

469,588 |

|

Held-to-maturity long-term investments |

|

|

— |

|

|

9,386 |

|

Available-for-sale long-term investments |

|

|

15,030 |

|

|

— |

|

Property and equipment, net |

|

|

21,694 |

|

|

16,905 |

|

Operating lease right-of-use assets |

|

|

8,793 |

|

|

— |

|

Deferred income taxes |

|

|

4,928 |

|

|

6,685 |

|

Intangibles, net |

|

|

13,637 |

|

|

459 |

|

|

|

|

6,340 |

|

|

— |

|

Other assets |

|

|

10,605 |

|

|

5,821 |

|

Total assets |

|

$ |

584,954 |

|

$ |

508,844 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

19,859 |

|

$ |

15,972 |

|

Wages and related accruals |

|

|

23,972 |

|

|

18,507 |

|

Customer advances |

|

|

7,899 |

|

|

2,962 |

|

Current operating lease liabilities |

|

|

3,380 |

|

|

— |

|

Income taxes payable |

|

|

1,065 |

|

|

— |

|

Other current liabilities |

|

|

10,778 |

|

|

7,425 |

|

Total current liabilities |

|

|

66,953 |

|

|

44,866 |

|

Deferred rent |

|

|

— |

|

|

1,173 |

|

Non-current operating lease liabilities |

|

|

6,833 |

|

|

— |

|

Other non-current liabilities |

|

|

250 |

|

|

150 |

|

Deferred tax liability |

|

|

— |

|

|

29 |

|

Liability for uncertain tax positions |

|

|

1,017 |

|

|

51 |

|

Commitments and contingencies |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, |

|

|

|

|

|

|

|

Authorized shares—10,000,000; none issued or outstanding at |

|

|

— |

|

|

— |

|

Common stock, |

|

|

|

|

|

|

|

Authorized shares—100,000,000 |

|

|

|

|

|

|

|

Issued and outstanding shares—24,063,639 shares at |

|

|

2 |

|

|

2 |

|

Additional paid-in capital |

|

|

181,481 |

|

|

176,216 |

|

Accumulated other comprehensive income |

|

|

328 |

|

|

2 |

|

Retained earnings |

|

|

328,090 |

|

|

286,351 |

|

|

|

|

509,901 |

|

|

462,571 |

|

Noncontrolling interest |

|

|

— |

|

|

4 |

|

Total equity |

|

|

509,901 |

|

|

462,575 |

|

Total liabilities and stockholders’ equity |

|

$ |

584,954 |

|

$ |

508,844 |

|

Consolidated Statements of Cash Flows (In thousands) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Year Ended |

||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

2018 |

|

|||

|

Operating activities |

|

|

|

|

|

|

|

|||||

|

Net income |

|

$ |

41,070 |

|

|

$ |

47,419 |

|

|

$ |

17,647 |

|

|

Loss (gain) on sale of business, net of tax |

|

|

265 |

|

|

|

(8,490 |

) |

|

|

— |

|

|

Loss from discontinued operations, net of tax |

|

|

— |

|

|

|

2,964 |

|

|

|

3,887 |

|

|

Net income from continuing operations |

|

|

41,335 |

|

|

|

41,893 |

|

|

|

21,534 |

|

|

Adjustments to reconcile net income from continuing operations to cash provided by operating activities from continuing operations: |

|

|

|

|

|

|

|

|

|

|||

|

Depreciation and amortization |

|

|

9,888 |

|

|

|

7,669 |

|

|

|

5,982 |

|

|

Losses from equity method investments |

|

|

5,487 |

|

|

|

3,944 |

|

|

|

1,283 |

|

|

Realized gain from sale of available-for-sale investments |

|

|

(180 |

) |

|

|

— |

|

|

|

— |

|

|

Impairment of long-lived assets |

|

|

— |

|

|

|

4,398 |

|

|

|

255 |

|

|

Provision for doubtful accounts |

|

|

388 |

|

|

|

(39 |

) |

|

|

977 |

|

|

Impairment of intangible assets and goodwill |

|

|

— |

|

|

|

— |

|

|

|

1,021 |

|

|

Other non-cash gain, net |

|

|

(703 |

) |

|

|

— |

|

|

|

— |

|

|

Non-cash lease expense |

|

|

4,574 |

|

|

|

— |

|

|

|

— |

|

|

Loss (gain) on foreign currency transactions |

|

|

1 |

|

|

|

38 |

|

|

|

(87 |

) |

|

Deferred income taxes |

|

|

3,419 |

|

|

|

4,792 |

|

|

|

2,853 |

|

|

Stock-based compensation |

|

|

6,227 |

|

|

|

6,985 |

|

|

|

4,956 |

|

|

(Gain) loss on sale of property and equipment |

|

|

(71 |

) |

|

|

76 |

|

|

|

20 |

|

|

Amortization of debt securities |

|

|

(1,423 |

) |

|

|

(1,506 |

) |

|

|

1,424 |

|

|

Changes in operating assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

|

|

|

|||

|

Accounts receivable |

|

|

(42,869 |

) |

|

|

25,821 |

|

|

|

11,070 |

|

|

Unbilled receivables and retentions |

|

|

(22,790 |

) |

|

|

(36,175 |

) |

|

|

2,253 |

|

|

Inventories |

|

|

8,855 |

|

|

|

(16,631 |

) |

|

|

1,192 |

|

|

Income tax receivable |

|

|

821 |

|

|

|

(821 |

) |

|

|

— |

|

|

Prepaid expenses and other assets |

|

|

831 |

|

|

|

(2,401 |

) |

|

|

139 |

|

|

Accounts payable |

|

|

3,127 |

|

|

|

(7,054 |

) |

|

|

5,736 |

|

|

Other liabilities |

|

|

8,180 |

|

|

|

(4,043 |

) |

|

|

9,224 |

|

|

Net cash provided by operating activities of continuing operations |

|

|

25,097 |

|

|

|

26,946 |

|

|

|

69,832 |

|

|

Investing activities |

|

|

|

|

|

|

|

|

|

|||

|

Acquisition of property and equipment |

|

|

(11,220 |

) |

|

|

(8,896 |

) |

|

|

(9,563 |

) |

|

Equity method investments |

|

|

(14,498 |

) |

|

|

(7,598 |

) |

|

|

(3,267 |

) |

|

Business acquisition, net of cash acquired |

|

|

(18,641 |

) |

|

|

— |

|

|

|

— |

|

|

Proceeds from sale of business |

|

|

— |

|

|

|

31,994 |

|

|

|

— |

|

|

Proceeds from sale of property and equipment |

|

|

81 |

|

|

|

— |

|

|

|

— |

|

|

Redemptions of held-to-maturity investments |

|

|

185,917 |

|

|

|

260,918 |

|

|

|

227,663 |

|

|

Purchases of held-to-maturity investments |

|

|

(176,757 |

) |

|

|

(267,122 |

) |

|

|

(221,680 |

) |

|

Redemptions of available-for-sale investments |

|

|

200,892 |

|

|

|

2,250 |

|

|

|

450 |

|

|

Purchases of available-for-sale investments |

|

|

(106,607 |

) |

|

|

— |

|

|

|

— |

|

|

Net cash provided by (used in) investing activities from continuing operations |

|

|

59,167 |

|

|

|

11,546 |

|

|

|

(6,397 |

) |

|

Financing activities |

|

|

|

|

|

|

|

|

|

|||

|

Principal payments of capital lease obligations |

|

|

— |

|

|

|

(161 |

) |

|

|

(288 |

) |

|

Payment of contingent consideration |

|

|

(868 |

) |

|

|

— |

|

|

|

— |

|

|

Tax withholding payment related to net settlement of equity awards |

|

|

(1,062 |

) |

|

|

(1,094 |

) |

|

|

(397 |

) |

|

Exercise of stock options |

|

|

100 |

|

|

|

71 |

|

|

|

2,705 |

|

|

Net cash (used in) provided by financing activities from continuing operations |

|

|

(1,830 |

) |

|

|

(1,184 |

) |

|

|

2,020 |

|

|

Discontinued operations |

|

|

|

|

|

|

|

|

|

|||

|

Operating activities of discontinued operations |

|

|

— |

|

|

|

(7,686 |

) |

|

|

(623 |

) |

|

Investing activities of discontinued operations |

|

|

— |

|

|

|

(431 |

) |

|

|

(1,219 |

) |

|

Net cash used in discontinued operations |

|

|

— |

|

|

|

(8,117 |

) |

|

|

(1,842 |

) |

|

Net increase in cash, cash equivalents, and restricted cash |

|

|

82,434 |

|

|

|

29,191 |

|

|

|

63,613 |

|

|

Cash, cash equivalents, and restricted cash at beginning of period |

|

|

172,708 |

|

|

|

143,517 |

|

|

|

79,904 |

|

|

Cash, cash equivalents, and restricted cash at end of period |

|

$ |

255,142 |

|

|

$ |

172,708 |

|

|

$ |

143,517 |

|

|

Supplemental disclosures of cash flow information |

|

|

|

|

|

|

|

|

|

|||

|

Cash paid, net during the period for: |

|

|

|

|

|

|

|

|

|

|||

|

Income taxes |

|

$ |

532 |

|

|

$ |

6,780 |

|

|

$ |

1,813 |

|

|

Non-cash activities |

|

|

|

|

|

|

|

|

|

|||

|

Unrealized gain on investments, net of deferred tax expense of |

|

$ |

50 |

|

|

$ |

57 |

|

|

$ |

70 |

|

|

Reclassification from share-based liability compensation to equity |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

384 |

|

|

Change in foreign currency translation adjustments |

|

$ |

276 |

|

|

$ |

(34 |

) |

|

$ |

36 |

|

|

Acquisitions of property and equipment included in accounts payable |

|

$ |

1,425 |

|

|

$ |

810 |

|

|

$ |

379 |

|

|

Reconciliation of non-GAAP Earnings per Diluted Share (Unaudited) |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Year Ended |

|

Year Ended |

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per diluted share from continuing operations |

|

$ |

0.73 |

|

$ |

0.26 |

|

$ |

1.72 |

|

$ |

1.74 |

|

|

Acquisition related expenses |

|

|

— |

|

|

— |

|

|

0.04 |

|

|

— |

|

|

Amortization of acquired intangible assets |

|

|

0.02 |

|

|

— |

|

|

0.08 |

|

|

— |

|

|

One-time gain from a litigation settlement |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.26 |

) |

|

Earnings per diluted share from continuing operations as adjusted (Non-GAAP) |

|

$ |

0.75 |

|

$ |

0.26 |

|

$ |

1.84 |

|

$ |

1.48 |

|

|

Reconciliation of Forecasted Earnings per Diluted Share (Unaudited)

|

|||

|

|

|

|

|

|

|

|

Fiscal year ending |

|

|

|

|

|

|

|

Forecasted earnings per diluted share from continuing operations |

|

$ |

1.65 - 1.85 |

|

Amortization of acquired intangible assets |

|

|

0.09 |

|

Forecasted earnings per diluted share from continuing operations as adjusted (Non-GAAP) |

|

$ |

1.74 - 1.94 |

Statement Regarding Non-GAAP Measures

The non-GAAP measure set forth above should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measure, and may not be comparable to similarly titled measures reported by other companies. Management believes that this measure provides useful information to investors by offering additional ways of viewing our results that, when reconciled to the corresponding GAAP measure, help our investors to understand the long-term profitability trends of our business and compare our profitability to prior and future periods and to our peers. In addition, management uses this non-GAAP measure to measure our operating and financial performance.

We exclude the acquisition-related expenses and amortization of acquisition-related intangible assets in fiscal 2020 and the one-time gain from a litigation settlement in fiscal 2019 because we believe this facilitates more consistent comparisons of operating results over time between our newly acquired and existing businesses, and with our peer companies. We believe, however, that it is important for investors to understand that such intangible assets contribute to revenue generation and that intangible asset amortization will recur in future periods until such intangible assets have been fully amortized.

For additional media and information, please follow us at:

Facebook: http://www.facebook.com/aerovironmentinc

Twitter: http://www.twitter.com/aerovironment

LinkedIn: https://www.linkedin.com/company/aerovironment

YouTube: http://www.youtube.com/user/AeroVironmentInc

Instagram: https://www.instagram.com/aerovironmentinc/

View source version on businesswire.com: https://www.businesswire.com/news/home/20200623005863/en/

+1 (805) 520-8350

ir@avinc.com

Source: